IndianOil HDFC Bank Credit Card Review In Hindi

IndianOil HDFC Bank Credit Card Review In Hindi :The IndianOil HDFC Bank Credit Card is a co-branded credit card offered by HDFC Bank in partnership with Indian Oil Corporation Limited (IOCL). This card is designed to reward customers for their fuel purchases and other transactions, making it an ideal choice for individuals who travel frequently by vehicle.IndianOil HDFC Bank Credit Card Review in Hindi.

IndianOil HDFC Bank Credit Card Features and Benefits

- –Fuel Benefits: Earn up to 50 liters of free fuel annually, with 5% of your spends as Fuel Points at IndianOil outlets, groceries, and bill payments.

- – Rewards: Earn 1 Fuel Point for every ₹150 spent on all other purchases, with redemption options for free fuel, catalogue products, or cashback.

- – Complimentary Membership: Get complimentary IndianOil XTRAREWARDSTM Program (IXRP) membership.

- – Revolving Credit: Enjoy revolving credit at nominal interest rates.

- – Zero Lost Card Liability: Report lost cards immediately to the 24-hour call center, with zero liability on fraudulent transactions.

- – Interest-Free Credit Period: Get up to 50 days of interest-free period on purchases.

- – Fuel Surcharge Waiver: Enjoy 1% fuel surcharge waiver at IOCL fuel stations.

IndianOil HDFC Bank Credit Card Fees and Charges

indianoil hdfc bank credit card annual fee

- – ₹500 + applicable taxes

- Annual Fee Waiver:

- – Spend ₹50,000 or more in the first year and get the annual fee waived

- Joining/Renewal Membership Fee: Rs. 500 plus applicable taxes (waived on spends of Rs. 50,000 in the first year)

- – Foreign Currency Markup: 3.5% of the amount transacted

- – Interest Rates: 3.6% per month (or 43.2% per annum)

- – Cash Advance Charges: 2.5% of the amount withdrawn subject to a minimum charge of Rs 500

- – Rewards Redemption Fee: Rs 99 per redemption request

- – 1% Fee on transaction amount: will be levied on rental transactions done on any applicable merchant for the month (fee capped at Rs 3000 per transaction, effective 1st August 2024)

Please note that fees and charges are subject to change, so it’s always best to check with HDFC Bank for the most up-to-date information

IndianOil HDFC Bank Credit Card Eligibility

To be eligible for the IndianOil HDFC Bank Credit Card, you must meet the following criteria:

- Age: You must be between 21 and 60 years old.

- Income: You must have a minimum annual income of ₹3 lakh.

- Credit Score: You must have a good credit history and a credit score of 650 or higher.

- Residency: You must be a resident of India.

- Identification: You must have a valid government-issued ID, such as a PAN card, Aadhaar card, or driver’s license.

- Address Proof: You must have a valid address proof, such as a utility bill or bank statement.

Additionally, HDFC Bank may consider other factors such as:

- – Employment status (salaried or self-employed)

- – Occupation

- – Education level

- – Existing credit relationships with HDFC Bank

Please note that eligibility criteria may vary, and HDFC Bank may have additional requirements. It’s always best to check with HDFC Bank directly for the most up-to-date eligibility criteria.

additional eligibility criteria for the IndianOil HDFC Bank Credit Card:

- Phone Number: You must have a valid phone number.

- Email ID: You must have a valid email ID.

- Bank Account: You must have a savings or current account with HDFC Bank or any other bank.

- Credit History: You must not have any outstanding debts or credit issues.

Documents required for application:

- ID Proof: PAN card, Aadhaar card, driver’s license, etc.

- Address Proof: Utility bill, bank statement, etc.

- Income Proof: Salary slip, Form 16, etc.

- Photograph: Recent passport-sized photograph.

Please note that the documents required may vary depending on the individual’s circumstances. HDFC Bank may also require additional documents or information to process the application.

It’s always best to check with HDFC Bank directly for the most up-to-date eligibility criteria and required documents.

How to Apply IndianOil HDFC Bank Credit Card Apply Kaise Kare

Here’s the step-by-step online application process for the IndianOil HDFC Bank Credit Card Apply :

Step 1: Visit the HDFC Bank website

– Go to (Link Here)

– Click on “Credit Cards” and then “IndianOil HDFC Bank Credit Card Apply ”

Step 2: Check Eligibility

– Click on “Check Eligibility” and fill in the required details

– Get instant eligibility results

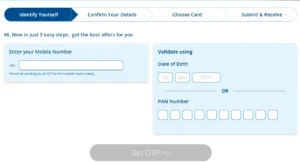

Step 3: Fill the Application Form

– If eligible, click on “Apply Now” and fill in the online application form

– Provide personal, income, and employment details

– Upload required documents (ID proof, address proof, income proof, etc.)

Step 4: Review and Submit

– Review the application form carefully

– Submit the form and get a reference number

Step 5: Verify and Activate

– HDFC Bank will verify your application and documents

– Once approved, activate your credit card by following the instructions provided

Alternative Option:

– You can also apply through the HDFC Bank mobile app or by visiting a nearby HDFC Bank branch.

Required Documents:

– ID proof (PAN card, Aadhaar card, driver’s license, etc.)

– Address proof (utility bill, bank statement, etc.)

– Income proof (salary slip, Form 16, etc.)

– Recent passport-sized photograph

Please note that the online application process may vary, and HDFC Bank may require additional documents or information to process the application.

You can apply for the IndianOil HDFC Bank Credit Card online through the HDFC Bank website or by visiting a nearby HDFC Bank branch.

Indianoil HDFC Bank Credit Card Charges

Here are the charges associated with the IndianOil HDFC Bank Credit Card:

IndianOil HDFC Bank Credit Card Annual Fees

- – Joining/Renewal Membership Fee: Rs. 500 + applicable taxes (waived on spends of Rs. 50,000 in the first year)

IndianOil HDFC Bank Credit Card Interest Charges

- – Interest Rate: 3.6% per month (or 43.2% per annum)

IndianOil HDFC Bank Credit Card Transaction Charges

- – Cash Advance Charges: 2.5% of the amount withdrawn (subject to a minimum charge of Rs. 500)

- – Foreign Currency Markup: 3.5% of the transaction amount

IndianOil HDFC Bank Credit Card Late Payment Charges

- – Rs. 500 or 5% of the outstanding amount, whichever is higher

IndianOil HDFC Bank Credit Card Other Charges

- – Overlimit Charges: Rs. 500 or 5% of the overlimit amount, whichever is higher

- – Card Replacement Charges: Rs. 200

- – Statement Retrieval Charges: Rs. 100 per statement

- – Rewards Redemption Fee: Rs. 99 per redemption request

IndianOil HDFC Bank Credit Card Fuel Transaction Charges

– 1% fuel surcharge waiver at IOCL fuel stations (effective 1st August 2024, a 1% fee on transaction amount will be levied on rental transactions done on any applicable merchant for the month, fee capped at Rs 3000 per transaction)

HDFC Credit Card Customer care

Here is the contact information for HDFC Credit Card Customer Care:

Phone:

- – Toll-free number: 1800-425-4332 (24/7)

- – General inquiries and credit card queries: 61606161

Email:

- – customerservices.cards@hdfcbank.com (for credit card-related queries and issues)

Mail:

- – HDFC Bank Cards Division, PO Box 8654, Thiruvanmiyur PO, Chennai – 600 041

Additional Contact Information:

- – Website: (link unavailable)

– Social Media: Facebook, Twitter, LinkedIn

– Branch Locator: Visit a nearby HDFC Bank branch for assistance

Working Hours:

- – Phone and email support: 24/7

- – Branch hours: Monday to Saturday, 9:30 am to 4:00 pm (Sunday closed)

Language Support:

– English, Hindi, and regional languages

Please note that the contact information may be subject to change, and it’s always best to check the HDFC Bank website for the most up-to-date information

Please note that these charges are subject to change, and you should always check with HDFC Bank for the most up-to-date information.

Conclusion of IndianOil HDFC Bank Credit Card

The IndianOil HDFC Bank Credit Card is a great option for those who travel frequently by vehicle, offering rewards and benefits on fuel purchases and other transactions. With its complimentary membership, revolving credit, and interest-free credit period, this card provides a convenient and rewarding experience for its customers.

हमारे WhatsApp Group Link को Join करें — Click Here

Telegram Group – Click Here

| Home | Click Here |

| Telegram Group | Click Here |